The DTF transfers business case is a practical compass for brands, studios, and print shops seeking to turn color into a repeatable, profitable offering that can scale with demand, while guiding decisions about equipment investment, operator training, and supplier partnerships, with a focus on ROI, cash flow, and capital efficiency. By anchoring planning in DTF transfers pricing, printers can map break-even points, target margins, and tiered pricing that reflect material and labor inputs, test sensitivity to volume, and align incentives across sales, production, and procurement teams, while exploring risk-adjusted pricing scenarios. A disciplined view of costs—film, inks, powders, heat-press wear, routine maintenance, and energy use—lets teams forecast DTF printing demand and align production capacity with actual market appetite, seasonal spikes, and evolving customer expectations, ensuring capacity is never overbuilt. Understanding direct-to-film transfer costs, including consumables, depreciation, utilities, and waste, enables smarter bundle pricing and more accurate quoting for small runs and high-variance orders, helping you protect margins as volumes fluctuate and quality remains consistent. When these elements are balanced through a structured model, the DTF transfers business case becomes a clear pathway to profitability, faster turnarounds, higher reliability, and durable customer value across product lines.

In practical terms, this topic can be framed as the economics of a modern garment-transfer workflow powered by film-based printing. Think of it as a cost structure and pricing strategy for a customizable print-on-demand service that converts art into wearable products. LSI-friendly terms include margins optimization, demand forecasting, capacity planning, procurement leverage, and the product mix that drives profitability. By using related concepts such as cost management, throughput efficiency, and buyer value, you can explore how technology choices impact margins and service levels.

DTF Transfers Pricing Fundamentals: Cost Drivers, Models, and Strategy

Understanding the pricing foundation for DTF transfers begins with the true cost per unit. When calculating DTF transfer costs, you must account for film, inks, powders, and adhesives, as well as equipment depreciation, utilities, labor, and any third-party design or finishing services. This lens—often referred to in industry discussions as DTF transfers pricing—ensures prices reflect the actual expense of producing each transfer and guards margins against unexpected variances.

To build a robust pricing framework, teams typically explore diverse models such as cost-plus pricing, tiered pricing for volume, value-based pricing, and market-driven adjustments. Each model interacts with the broader DTF pricing landscape, where variables like material efficiency, supplier terms, and regional demand can swing unit costs. A disciplined approach to calculating direct-to-film transfer costs yields defendable prices that support sustainable margins.

Maximizing DTF Transfer Margins Through Operational Excellence

Margins translate price into profit by balancing gross and net considerations. In the context of the DTF transfers business, DTF transfer margins are highly sensitive to both production costs and operating expenses. A healthy margin often arises from optimizing variable costs (ink, film, powder, adhesive) while strategically allocating fixed costs (equipment depreciation, rent, software licenses) across higher throughputs.

Operational discipline—throughput optimization, waste reduction, and streamlined labor—plays a critical role in margin realization. By improving first-pass quality and reducing reprints, a shop can protect margins even when demand fluctuates. These margin-driving actions align closely with the broader objective of DTF business case profitability, ensuring pricing remains resilient in the face of shifting costs and competitive pressure.

DTF Printing Demand: Forecasting and Aligning Capacity

DTF printing demand is driven by consumer trends, retailer needs, and the appeal of flexible, on-demand customization. Understanding DTF printing demand helps shape pricing strategies, capacity planning, and inventory decisions, ensuring production can respond to short lead times and small-batch requests without tying up capital.

Accurate demand forecasting combines analysis of seasonal campaigns, product life cycles, and market tests. Lean inventory practices and flexible supplier relationships enable teams to scale up or down in response to demand spikes. A clear view of DTF printing demand supports smarter capacity allocation and reduces the risk of overextension in the DTF pricing and margins equation.

DTF Transfers Business Case: A Framework for Pricing, Costs, and Profitability

The DTF transfers business case provides a structured way to evaluate profitability by integrating pricing, costs, and demand signals. In this framework, DTF transfers pricing decisions are tied directly to margins, while demand forecasts inform capacity and capital needs. Leveraging insights from this business case helps owners pursue a path to profitability that balances competitive pricing with sustainable operations.

Practical steps include benchmarking costs (film, ink, powder, labor, utilities, depreciation), modeling multiple pricing scenarios (cost-plus, volume-based, value-based), and projecting demand to inform capacity planning. Emphasizing DTF business case profitability means continuously testing assumptions, tracking realized versus projected margins, and adjusting pricing or investment as market conditions evolve.

Cost Structure and Direct-to-Film Costs: Managing the Components

Direct-to-film costs form a core portion of the unit economics for DTF transfers. Key components—film, inks, powders, and adhesive—vary with color, coverage, and production volume. Efficient color management and waste reduction help minimize these costs, while equipment depreciation and maintenance must be allocated to each transfer to reflect true profitability.

Beyond materials, utilities, labor, and packaging also shape per-unit economics. Disciplined procurement, supplier term negotiations, and supplier diversification can stabilize direct-to-film costs and protect margins during price swings. By actively managing these cost components, businesses can maintain healthy pricing power and support consistent DTF pricing discipline.

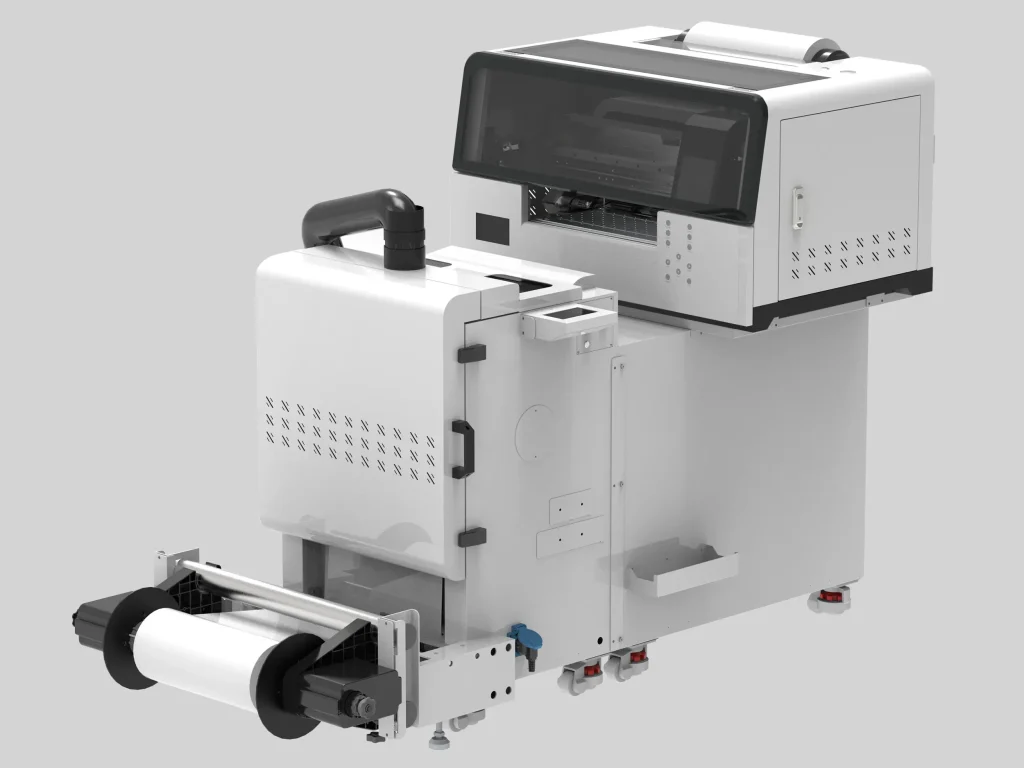

Operational Excellence: Streamlining Workflows for Competitive DTF Printing

Operational excellence directly affects the ability to meet DTF printing demand with quality and speed. A well-designed production workflow minimizes touches, standardizes settings for repeat jobs, and reduces cycle times, all of which contribute to more predictable unit costs and stronger DTF transfer margins.

Investing in color management, inline quality checks, preventive maintenance, and data analytics creates a feedback loop that identifies bottlenecks and quantifies improvements. This disciplined approach supports pricing flexibility, sharper margins, and a competitive edge in the evolving DTF market, reinforcing the broader goal of profitable, scalable DTF transfers.

Frequently Asked Questions

What is the DTF transfers business case and how does it guide pricing and margins?

The DTF transfers business case is a numbers-backed view of pricing, margins, and demand used to decide whether to adopt or scale DTF transfers. It blends cost data, pricing strategies, and demand intelligence to inform decisions that drive profitability, faster turnaround, and flexible production. By focusing on the intersection of pricing models, margins, and demand, it provides a clear roadmap for scalable DTF initiatives.

How do direct-to-film transfer costs influence DTF pricing and transfer margins?

Direct-to-film transfer costs—film, inks, powders, adhesive, equipment depreciation, utilities, and labor—directly shape the unit cost and, in turn, the DTF pricing and transfer margins. A disciplined, data-driven view of these costs helps set realistic price points and preserve healthy gross and net margins across varying volumes.

Which pricing models best optimize DTF transfer margins?

Effective DTF pricing often combines cost-plus pricing, tiered volume discounts, value-based pricing for complex or durable jobs, and market-driven adjustments. Using these models within the DTF transfers business case helps balance competitive pricing with strong margins.

What factors drive DTF printing demand and how do they affect the DTF business case profitability?

DTF printing demand is propelled by customization, short lead times, product diversity, and micro-brand adoption, along with perceived durability. These drivers influence demand forecasting and capacity planning, shaping the DTF business case profitability by aligning pricing, production pace, and service levels with market appetite.

How can you forecast DTF printing demand to avoid capacity gaps and protect margins?

Forecasting demand involves analyzing customer segments, campaigns, seasonality, and product life cycles to project orders and capacity needs. Use these insights to plan procurement, staffing, and pricing, ensuring you meet demand without overextending resources within the DTF transfers business case.

What steps create a practical blueprint to improve DTF pricing and margins?

A practical blueprint includes: benchmark costs, model pricing scenarios (cost-plus, volume-based, value-based), project demand and capacity, optimize operations, run pilots, and regularly review and adapt. This structured approach supports improved DTF pricing and margins and drives profitability within the DTF transfers business case.

| Aspect},{ | |

|---|---|

| Overview | DTF printing enables brands, designers, and print shops to diversify offerings with lower upfront setup costs, while the business case analyzes pricing, margins, and demand to guide scaling decisions. |

| Pricing Fundamentals | Cost per unit includes film, inks, powders, consumables, equipment depreciation, utilities, labor, and optional third-party services. Pricing models: cost-plus, tiered volume, value-based, and market-driven. |

| Margins | Focus on gross vs net margins; target net margins commonly 15–40% with efficient operations, procurement, and product mix. Consider variable costs, fixed costs, labor, waste, and quality. |

| Demand Drivers | Customization, short lead times, product diversity, small-business adoption, and durability drive demand; forecast via campaigns, seasonality, and product life cycles; lean inventory and flexible suppliers help manage spikes. |

| Cost Structure | Direct film costs, inks/powders, equipment depreciation, utilities/maintenance, labor, and packaging/shipping; disciplined procurement and supplier terms stabilize unit costs. |

| Operational Excellence | Workflow design, color management, quality control, maintenance, and data analytics; environmental and regulatory considerations for efficiency and sustainability. |

| Competitive Landscape | Differentiation through quality, customization, service levels; niche focus, design automation, bulk discounts, and hybrid production models. |

| Implementation Blueprint | Benchmark costs, model pricing, forecast demand, optimize operations, pilot and scale, review and adapt. |

Summary

DTF transfers business case is a dynamic framework that balances pricing, costs, and demand to create profitability with scalable operations. By understanding true production costs, setting disciplined prices, and aligning capacity with market demand, brands and print shops can build a durable path to growth for DTF transfers. Successful adoption hinges on continuous optimization of pricing models, margins through operational excellence, and responsiveness to demand trends, ensuring high-quality transfers, satisfied customers, and sustainable profitability over time.